Navigating Kakobuy Shipping: Customs Clearance Differences by Region & Spreadsheet Mastery

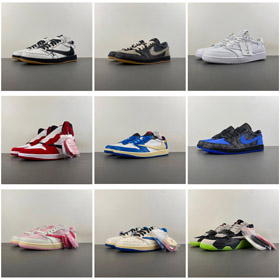

For international shoppers engaging in daigou (cross-border purchasing) on Kakobuy, understanding the nuances of customs clearance across different countries and regions is critical to ensuring seamless deliveries. Kakobuy, a popular platform for global fashion, electronics, and luxury goods (explore hot picks at https://kakobuy.fun/hot), connects buyers with a diverse range of products—from Jordan 4 Retro sneakers to Louis Vuitton bags and AirPods. However, varying customs regulations, documentation requirements, and tax policies can pose challenges. By leveraging the Kakobuy Spreadsheet to track these differences and adhering to platform guidelines, you can streamline the clearance process and avoid delays, seizures, or unexpected costs. This guide breaks down regional clearance disparities, spreadsheet setup, and pro tips for successful daigou.

Understanding Customs Clearance Differences Across Key Regions

Customs clearance procedures are shaped by each country/region’s trade policies, tax thresholds, and product-specific regulations. Below is a breakdown of critical differences for major target markets of Kakobuy shoppers:

1. North America (United States & Canada)

United States:

Customs thresholds: Goods valued below $800 are generally duty-free (for personal use). Shipments exceeding this amount are subject to duties/taxes based on product category (e.g., 10-20% for footwear, 2.5-5% for electronics).

Documentation: Requires a detailed commercial invoice listing product descriptions, quantities, values, and HS codes. Personal shipments must be marked “Gift” or “Personal Effects” to avoid commercial scrutiny.

Restrictions: Strict on counterfeit goods (Kakobuy’s authentic products mitigate this risk), but items like luxury goods may require proof of authenticity to avoid seizure.

Canada:

Duty-free threshold: CAD $20 for most goods; CAD $800 for stays abroad exceeding 48 hours (applicable to daigou for personal use).

Taxation: Goods over the threshold are subject to GST/HST (5-15%) plus provincial taxes. Footwear and apparel may have additional duties (e.g., 18% for leather shoes).

Documentation: Mandates a clear invoice with product details and a “Personal Use Declaration” to distinguish from commercial imports.

2. European Union (EU)

Thresholds & Taxes:

Duty-free limit: €150 for goods from non-EU countries. Shipments above this incur customs duties (varies by product: e.g., 12% for fashion items, 0% for most electronics) plus VAT (15-27% depending on the country).

IOSS (Import One-Stop Shop): Kakobuy may use IOSS for low-value shipments, allowing VAT to be collected upfront—ensuring faster clearance without post-delivery tax bills.

Documentation: Requires an EU-compliant commercial invoice, HS codes, and proof of origin (if applicable). Luxury goods (e.g., Rolex watches, Louis Vuitton bags) may need authenticity certificates.

Restrictions: Strict on counterfeits and banned substances (e.g., certain textiles). Ensure products meet EU safety standards (e.g., CE marking for electronics like AirPods).

3. Asia-Pacific (Japan, Australia, Singapore)

Japan:

Duty-free threshold: ¥10,000. Goods above this are subject to duties (e.g., 20% for leather goods, 0% for electronics) and consumption tax (10%).

Documentation: Requires a detailed invoice and “Personal Import Declaration.” Luxury items may require additional paperwork to prove authenticity.

Speed: Generally fast clearance (3-5 days) for personal shipments, but peak seasons (e.g., holidays) may cause delays.

Australia:

Threshold: AUD $1,000 (duty-free for personal use). Shipments over this incur GST (10%) plus duties (e.g., 15% for footwear, 5% for electronics).

Biosecurity Checks: Strict on items with materials like leather or fabric (e.g., AMIRI jeans, UGG boots) – ensure packaging is clean and free of contaminants.

Documentation: Requires an invoice and “Import Declaration Form” for goods over AUD $1,000.

Singapore:

Duty-free for most personal goods (no threshold for low-value items). Only specific products (e.g., tobacco, alcohol) incur duties.

GST: 8% on goods valued above SGD $400.

Clearance Speed: Typically 1-2 days for personal shipments, with minimal documentation required (simplified invoice sufficient).

4. Middle East (UAE, Saudi Arabia)

UAE:

Duty-free threshold: AED 3,000. Goods above this incur 5% customs duty (flat rate for most items) plus VAT (5%).

Documentation: Requires a commercial invoice, passport copy, and “Personal Import Declaration.” Luxury goods may need authenticity proof.

Restrictions: Conservative regulations on apparel (e.g., revealing designs) – ensure products comply with local cultural norms.

Saudi Arabia:

Threshold: SAR 1,000. Shipments over this incur 15% VAT and duties (varies by product: e.g., 20% for fashion, 0% for electronics).

Documentation: Mandates a detailed invoice, passport copy, and approval from the General Authority of Customs for high-value items.

Setting Up Your Kakobuy Spreadsheet to Track Clearance Details

To stay organized and avoid oversights, create a customized Kakobuy Spreadsheet (using Google Sheets, Microsoft Excel, or similar tools) to document regional clearance requirements, shipping details, and key notes. Below is a recommended template with core columns:

| Column Header | Description | Example Entries |

|---|---|---|

| Target Country/Region | The destination for your shipment (e.g., EU - Germany, Japan) | EU - France, Australia |

| Kakobuy Product Details | Product name, style code, and quantity (from https://kakobuy.fun/hot) | Jordan 4 Retro -0001 (1 pair), AirPods 3 -0102 (1 unit) |

| Total Shipment Value | Combined value of products (USD, as listed on Kakobuy) | $34.25 (Jordan 4) + $7.53 (AirPods 3) = $41.78 |

| Customs Threshold | Duty-free limit for the destination | EU: €150, Australia: AUD $1,000 |

| Required Documentation | Mandatory paperwork for clearance | EU: IOSS invoice + HS codes; Australia: Biosecurity form |

| Duties & Taxes Estimate | Calculated costs (convert to your currency) | EU: €0 (below threshold) + VAT €3.34 (8% of $41.78) |

| Kakobuy Platform Tips | Guidelines from Kakobuy (e.g., packaging, labeling) | “Mark as Personal Use”; “Include authenticity cert for luxury goods” |

| Additional Notes | Restrictions, peak season delays, or contact info | “Japan: Avoid shipping during Golden Week (late April-early May)”; “Australia: Clean packaging for fabric items” |

| Clearance Status | Track progress (e.g., In Transit, Cleared, Delivered) | In Transit → Cleared (3 days) → Delivered |

How to Populate the Spreadsheet Effectively

Extract Product Data: From Kakobuy’s hot page (https://kakobuy.fun/hot), note the product name, style code, and price (e.g., Prada Casual Sneakers -0015: $38.08; Dior B30 Series -0416: $45.21).

Research Regional Rules: Use official customs websites (e.g., EU’s IOSS portal, Australia’s ABF) or Kakobuy’s shipping guides to confirm thresholds, documentation, and taxes.

Leverage Kakobuy’s Hints: Check the platform’s shipping page for destination-specific tips (e.g., “For UAE shipments: Avoid packaging with explicit branding”).

Update in Real-Time: As you process the order, record tracking numbers, documentation submitted, and clearance updates to maintain visibility.

Pro Tips to Ensure Smooth Customs Clearance on Kakobuy

Adhere to Kakobuy’s Packaging Guidelines: The platform recommends using discreet packaging for luxury goods (e.g., Louis Vuitton bags, Cartier sunglasses) to avoid unnecessary scrutiny. Avoid overbranding the exterior.

Be Accurate with Invoices: Never understate product values to avoid duties—this can lead to seizure or fines. Use Kakobuy’s official invoices, which include accurate HS codes and product descriptions.

Prepare Authenticity Documents: For high-value items (e.g., Rolex watches, Alexander McQueen sneakers), request authenticity certificates from Kakobuy sellers and include them in the shipment. This speeds up clearance for regions like the EU and Japan.

Check Restrictions in Advance: Use your spreadsheet to flag prohibited items (e.g., certain electronics in the Middle East, counterfeit goods globally). Kakobuy vets sellers, but it’s your responsibility to confirm compliance.

Use Kakobuy’s Preferred Shipping Partners: The platform collaborates with trusted carriers (e.g., DHL, FedEx) that have experience with regional clearance. These carriers often provide end-to-end tracking and assist with documentation.

Plan for Peak Seasons: Update your spreadsheet with regional peak periods (e.g., Christmas in the US/EU, Chinese New Year in Asia) and allow extra time for clearance.

Resolving Common Clearance Issues

Delays Due to Missing Documentation: Refer to your spreadsheet to confirm all required paperwork is included. Contact Kakobuy’s customer service to request missing documents (e.g., authenticity certs) promptly.

Unexpected Taxes/Duties: Use your spreadsheet’s tax estimate column to budget for additional costs. If charged more than expected, dispute it with customs using Kakobuy’s invoice as proof of value.

Seizure Risk: If a shipment is flagged, provide customs with documentation from your spreadsheet (e.g., personal use declaration, authenticity proof) to demonstrate compliance. Kakobuy’s buyer protection may assist with disputes.

Final Thoughts

Kakobuy offers a wealth of global products, but successful daigou hinges on mastering regional customs clearance. By using the Kakobuy Spreadsheet to track differences in thresholds, documentation, and taxes, and following the platform’s guidelines, you can minimize risks and ensure your purchases (from Jordan sneakers to Dior perfume) clear customs smoothly. Start by exploring Kakobuy’s hot products at https://kakobuy.fun/hot, set up your spreadsheet, and embark on a stress-free cross-border shopping journey. With careful planning and organization, you’ll turn international 代购 into a seamless process.